Why this matters for PE, VC & growth investors

Founder and operator risk = deal risk. But most early-stage checks rely on self-reported information and manual research.

Curated profiles

Pitch decks, bios and LinkedIn profiles are curated. They hide gaps, failures, conflicts or embellished histories.

Fast research

Deal velocity pressures teams to move fast, often before deep checks can be conducted.

Discreet diligence

Early diligence must be discreet. You cannot disclose interest or spook a founder pre-term-sheet.

Consistent results

Manual OSINT is slow, inconsistent and incomplete, especially under competitive timelines.

Protect reputation

A single missed red flag can lead to blown deals, reputational damage, investor liability or downstream portfolio risk.

See sample report

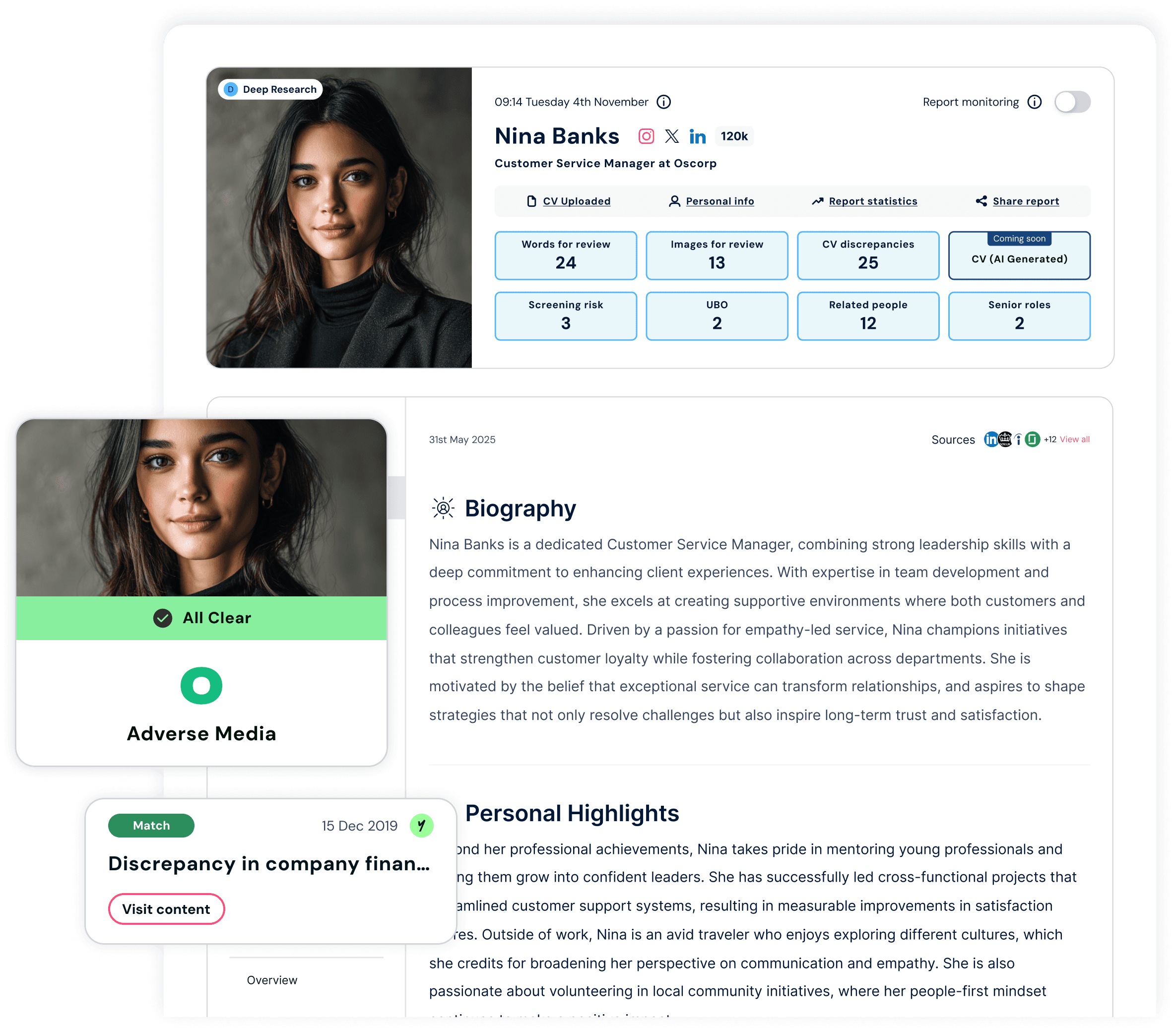

Candidate materials tell part of the story. YOONO reveals the rest.

How YOONO supports PE, VC & growth investors

YOONO surfaces people-risk signals early in the deal cycle, giving investment teams fast, defensible clarity on founders, operators and key executives.

A single Deep Research report replaces hours of manual searching and allows teams to scale people-risk diligence across multiple deals.

How YOONO supports due diligence

Turn slow, manual people-research into a consistent and defensible workflow.

1

Submit the subject

Enter a name and any known associated company. YOONO identifies the correct person even across common names or complex founder histories.

2

Deep public-data intelligence

Corporate records, ownership, networks, media, litigation references, reputational patterns and regulatory signals. Analysed in minutes.

3

Audit-ready report

A structured, defensible report for deal teams, talent partners and IC submissions, helping you make confident early-stage decisions.

Why PE/VC teams rely on YOONO

Public-data intelligence that strengthens your decisions, your governance, and your audit trail.

Run discreet, no-consent checks.

Vet founders and key operators without alerting them.

Essential for competitive or sensitive deal processes.

Avoid prematurely signalling interest before alignment is established.

Validate self-reported information.

Compare deck claims, CVs and LinkedIn with verified public records.

Spot gaps, inconsistencies or over-embellished achievements.

Reveal dissolved entities, failed ventures or hidden co-founders.

Avoid deal and reputational risk.

Surface red flags before term sheets or deep diligence.

Strengthen IC papers with defensible, evidence-backed insight.

Avoid surprises that erode confidence post-investment.

Replace manual OSINT.

Automate hours of fragmented research across registries and web sources.

Eliminate inconsistent diligence quality across analysts or consultants.

Scale people-risk checks across higher deal volume.

Trusted by regulated teams who cannot afford to get people-risk wrong

YOONO industry insight

Stay ahead of people-risk, regulatory expectations and due-diligence trends with practical guidance from the YOONO team.